Sponsored content:

The recent COVID-19 pandemic has made it difficult to plan much in the way of the future right now. From when your children will go back to school to when you will return to the office, it feels like there isn’t much we have control of. This is particularly true when it comes to your finances. Whether you are thinking about job security, your retirement or your financial portfolio, uncertainty abounds. However, I would argue that there is no better time than right now to think about your financial future and evaluate where you are today and where you want to be in the years to come.

Simply counting on investment performance goals is not a true financial plan. Financial planning looks different for everyone, and it should. Everyone has individual priorities, philosophies and values. All of which should be reflected in a unique financial plan that fits your lifestyle as well as your short- and long-term goals. As you look at putting a financial plan in place or updating your current plan, here are some topics to consider and questions to ask.

Start with a Financial Review

If you haven’t already, conducting a personal financial review is the first step to creating your financial plan. A solid financial review with an advisor will help you recalibrate where you are today and where you want to go in the future by looking at your current spending and saving habits to help establish your plan’s baseline. You will review your current assets, debts and income to determine the variables that can influence your plan’s success. Once you have created a foundational financial plan, you will start to discuss your concerns, passions, plans and issues to help shape and define your financial journey. Some of these discussions will include your family, career, lifestyle and retirement goals.

Put Family First

Thinking about your family—or the family you’d like to have in the future—is an important part of your financial plan. Whether you are planning to have children or thinking about how you will pay for their education, there are many ways to start preparing today. This can include starting a health savings account (HSA) for future medical expenses, looking into financial options for adoption, flexible savings account (FSA) considerations for childcare, and starting a 529 or other higher-education savings plan.

There are many conversations and questions that come into play as you plan for your family’s financial future, including:

- Do you want to pay for all of your child’s college education or a certain percentage?

- Do you want your children to attend public or private school?

- Do you have a will or trust set up for your child/children?

- What does your estate plan look like and who are your beneficiaries?

Since there are several aspects of your financial plan that involve your family, it’s important to ask these questions today and continue to consider them as your plan evolves.

Career + Lifestyle Decisions

What does your career trajectory look like? Do you plan to retire at your current company, or have you always wanted to explore a second career that involves your passions? Do you want to take a family vacation to Hawaii or a two-week adventure to Europe? If yes, how are you planning for these wants now so you can enjoy them in the future?

Conversations about your wants and desires regarding your career, travel and lifestyle should be factored into your financial plan. Philanthropy should also be a part of this conversation. Do you want to contribute your time and money to nonprofits that matter to you? Have you thought about how to do this on a weekly, monthly or annual basis? Many people want to give back to organizations that are adding good to their community and the world. This conversation will also lead into your estate planning desires and the legacy you want to leave after you are gone.

Retirement Considerations

Do you want to retire at 55 or do you love to work and plan to do so into your 70s? No matter the age you want to retire, it’s important to know what you need to get there. Planning for your retirement should be an active exercise, not a passive conversation, that looks at your 401K and other investment accounts every year. You should be discussing what your pre-retirement and post-retirement plans look like for you and your family. Some questions to consider: Will you and your spouse retire at the same time? What will you do in retirement—travel, spend time with family, work part-time? Where will you live and what does that look like? By thinking and talking about your long-term dreams, you can start planning and budgeting today.

The First Step

I know it may be hard to think about some of these questions and long-term plans right now as we simply try to get through the days and weeks ahead. But I encourage you to think about your financial future and what that looks like in the years to come. As you think about these questions, consider partnering with a financial advisor to help you reach your short- and long-term objectives. When you have a financial advisor who is focused on your unique journey, he or she can help you discover your areas of strength and identify improvements to maximize success. A financial advisor will help optimize your lifestyle, establish your legacy, and build your wealth for today and the long term.

Nikki Newton is president of UMB Private Wealth Management and can be reached at Nikki.Newton@umb.com.

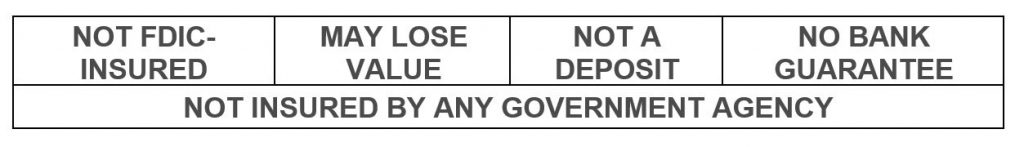

Banking products offered by UMB Bank, n.a. Member FDIC. Insurance products offered through UMB Insurance, Inc. a wholly-owned subsidiary of UMB Bank, n.a.