Sponsored content:

The numbers are staggering—an estimated $25-30 trillion of inheritance wealth will be passed down to the next generation in the next three to four decades. “More and more women are controlling that money,” says Christine Graham, Director of Trust Administration and Chief Fiduciary Officer at UMB Bank. “These are some really big numbers, and they illustrate why it’s important for women to understand the steps they need to take when they’re managing these wealth transfers.”

Graham and her team of financial professionals have some insight on steps you need to take to be proactive, safe, and mindful with newly acquired funds.

First and Foremost? Work to Assemble a Team of Advisors You Trust

A majority of women are either uncomfortable when it comes to dealing with finances or simply wary(is there a source for that?). “It may be a new concept for them—and that’s why we’re here to help and to educate,” says Graham. Finding a knowledgeable advisor is a top priority. “You need an advisor you can trust, someone you feel comfortable with,” she says. “To have that connection is an important starting point, especially when you’re sharing some very personal information with these individuals.” Graham counsels to be mindful of finding an advisor bound by a fiduciary standard: “Someone who is legally required to put your best interests first.”

Next up? If need be, let advisors work together to put your funds to work. “Depending on the circumstances and what you’re inheriting, you may need a team of advisors with varying expertise,” says Graham, who mentions investment brokers, financial managers, estate planning attorneys and/or tax planning attorneys to help accordingly. “The hallmark of a great advisor is someone who is a really good listener. They will listen to your goals. They’ll gather information and then ask lots questions before discussing planning options.”

Money Is Not a Taboo Subject

Graham says that occasionally older women can simply be apprehensive to discuss their wealth. “It’s a generational challenge,” she admits. “Individuals from my parents’ and grandparents’ generations did not talk about money—and especially women, they never talked about it. It was a subject you didn’t broach.”

Instead of shying away from finances, Graham says it’s all about empowering yourself—especially if you feel uninformed. “Some women find themselves uncomfortable with their lack of knowledge and experience. We are here to help you every step of the way, and that starts with identifying your goals,” she says. “Determine what you want to achieve with your wealth, whatever that may be. There are so many planning options available these days. There are usually multiple ways of achieving both your financial and family goals.”

A Family Affair?

While it’s important to have professional support with managing a wealth transfer, family input, in some cases, can be beneficial. Graham says, “I’ve always encouraged my clients to talk to their families and explain the whybehind their planning,” she says. “It’s a lot easier to accept if family members know the reasoning behind a plan than it is to have it thrust upon them with no context. Open communication is always a really good thing; a positive thing. Your advisors can help with those conversations because we know they can be stressful and confusing.”

The Two Biggest Mistakes?

Failing to establish a plan at all and relying on state law, or merely having a rudimentary estate plan not tailored to your individual goals and circumstances, can pose countless challenges. “It can be a serious problem,” Graham says. “Always, always have a plan.” Without T’s crossed and I’s dotted, your wealth can be at risk.

The second biggest mistake? “Having a plan, setting that plan aside and then never looking at it again. It’s never a one-and-done situation,” Graham says. “Make sure the plan continues to fit your family—and you. Think of it as a living document that needs to be tweaked as you go through different keystone moments in your life.” From marriages to retirement to divorces, milestones can impact the plan you currently have in place. And, there’s absolutely zero harm in clients being assertive about their ongoing goals and expectations—in fact, Graham encourages it. “It’s your plan, own it. Take control of the process and make sure everyone is on the same page in terms of what you’re trying to achieve.”

Safety First

For folks who have recently acquired sizeable sums of money, Graham says that personal security can be a factor people don’t often consider. It’s a risk worth noting. “It’s certainly not something people talk about,” she says. “Many people don’t recognize that when you inherit a lot of money—and it’s made public—you can become a target. Knowing and understanding that you need to take care of your personal security, to shield yourself and your family, should be factored in and become part of your plan.”

Finally, being forthright and transparent with your advisors is paramount, says Graham.

“We struggle with clients who withhold information. Maybe there are family members who are dealing with issues, such as mental health, addictive behavior, or things that carry a social stigma, and they are hesitant to share that information with their planners. The more we know, the more we can help. There’s a lot of really good planning that can be done to protect those individuals and, as such, you need to set aside any potential embarrassment and focus on developing an effective plan.”

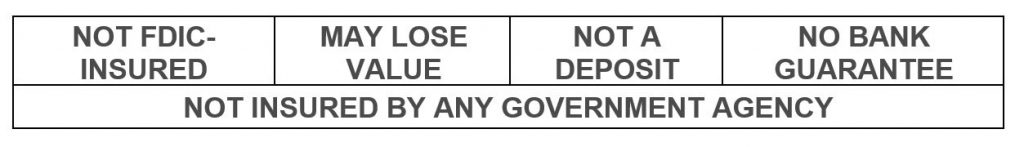

Banking products offered by UMB Bank, n.a. Member FDIC. Insurance products offered through UMB Insurance, Inc. a wholly-owned subsidiary of UMB Bank, n.a.